The Business Need

Preparation-H team wanted to find answers to questions many brands should be asking themselves in today’s reality:

- Should we have a presence on social media? If so, where?

- How do we align our brand comms with the voice of our consumer (Starting with basics, including - how do customers refer to our brand?)

- What should the tone of our social voice be? (Our early thinking was that we should opt for an informative & formal persona)

- What opportunities are there, outside of direct product mentions, to drive awareness and engagement within our target audience?

In the past, those questions would be addressed by traditional research methodologies such as focus groups. While a good source of information, these typically take time, require substantial budget and are limited when it comes to scope. None of these barriers exist for social and so we set out to explore the category and uncover consumer insights.

Building the Query - Brand

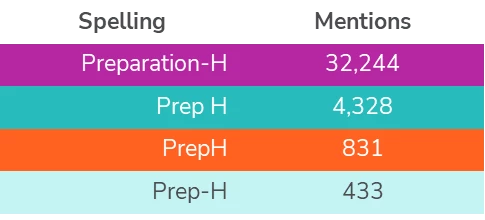

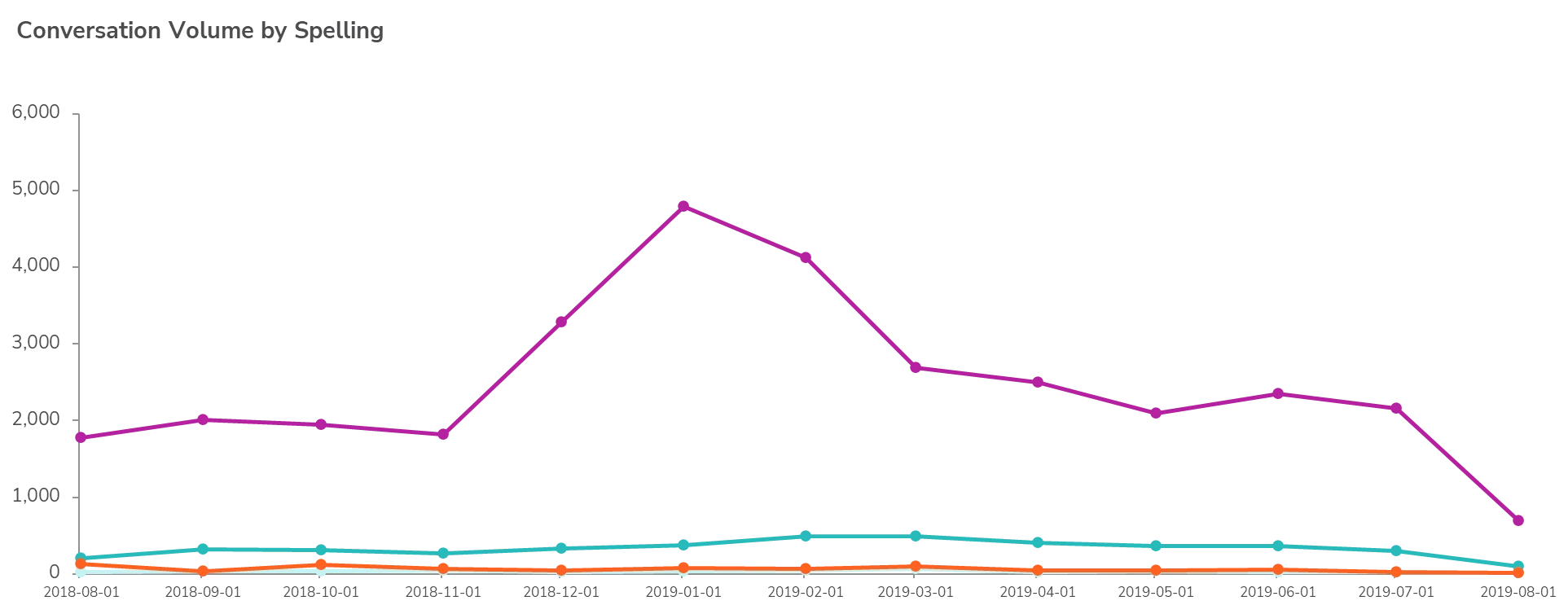

Internally, we often refer to this brand as “Prep H”. We weren’t sure whether this shorthand form is mirrored by our customers, and would we run a risk of alienating certain groups by excluding multiple variations of our brand name. It’s an intricate balance between capturing what’s relevant and ensuring relatively clean data.

Early testing and research showed that, whilst the majority of consumers use the long tail brand name, Preparation H, there’s a sizable chunk of mentions using the variations. We made sure our keywords mirror the language used by online users, and we did this to the character.

Using Meltwater Explore, we can specify our queries to the character, in this case “Prep H” (space), “Prep-H” (hyphen), “PrepH” (no space), “Preparation-H” (full spelling)

Here is how we created the queries:

- In Explore, click on Create under the Advanced Search Box

- Build 4 separate queries, one for each spelling iteration. (e.g query 1 is just “Prep H”)

- Save each

- Return to Explore Home Page

- Click on Create under the Combined Search Box

- In the All of these Box , select the 4 queries

- Click Apply

Building the Query - Purchase Intent

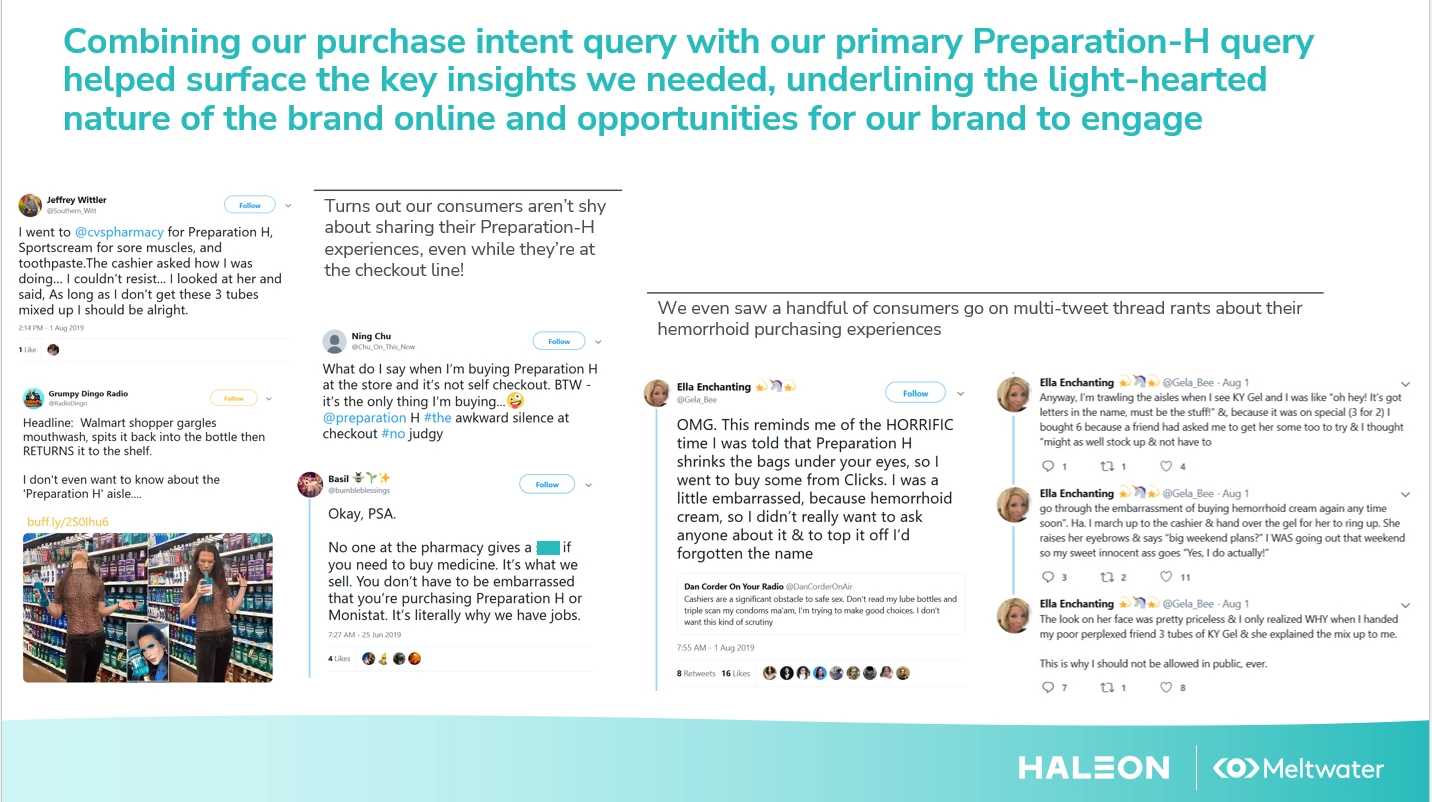

We built the purchase intent query to understand how our customers discuss their buying experience. We wanted to get insight into the offline purchase journey and we were not disappointed! The results were eye opening and revealed the humor and light hearted conversations our brand drove, without us even knowing!

Here is a sample of Purchase Intent Boolean:

Want It: Preemptively/Proactively

((("want to" OR "wanted to" OR "going to" OR "gonna" OR "got to" OR "plan to" OR "planned to" OR "planning to" OR "need to" OR "needed to" OR "have to" OR must OR "wish to" OR "wished to" OR "looking to" OR "where do I" OR "where to" OR "where do we" OR "where can i" OR "where can we" OR "how do i" OR "how do we" OR "how do you" OR "how can i" OR "how can you" OR "how can we" OR "what do i" OR "what to" OR "what do we" OR "what can i" OR "should i" OR "should we" OR "i should" OR "we should" OR "we should" OR "ought to" OR "desire to" OR "where did you" OR consider OR considers OR considered OR considering) NEAR/2 (buy OR purchase OR order))

Want It: Actively

OR "want to get" OR "wanted to get" OR "going to get" OR "gonna get" OR "got to get" OR "plan to get" OR "planned to get" OR "planning to get" OR "need to get" OR "needed to get" OR "have to get" OR "must get" OR "wish to get" OR "consider to get" OR "considering to get" OR "wished to get" OR "looking to get" OR "where do I get" OR "where to get" OR "where do we get" OR "where can i get" OR "where can we get" OR "how do i get" OR "how do we get" OR "how do you get" OR "how can i get" OR "how can you get" OR "how can we get" OR "what do i get" OR "what do we get" OR "what can i get" OR "must get" OR "should i get" OR "should we get" OR "i should get" OR "we should get" OR "we should get" OR "ought to get" OR "desire to get" OR "where did you get" OR "want to have" OR "need to have" OR "where do I find" OR "where do we find" OR "where do you find" OR "where to find" OR "where can i find" OR "where can you find" OR "where can we find" OR "how do i find" OR "how do we find" OR "how do you find" OR "how can i find" OR "how can you find" OR "how can we find" OR "i want chapstick" OR "i need chapstick" OR "all i want" OR "i want those" OR "i need those" OR "i want some" OR "i need some" OR "wish i had" OR "i wish we had" OR "any recommendation" OR "any recommendations" OR "do you recommend" OR "looking for recommendation" OR "looking for recommendations" OR "any preference" OR "what is your fav" OR "what is your favorite"))

NOT (RT OR supplies OR "right order" OR available OR "in order" OR "order number" OR "order directly" OR "go order" OR "your order" OR "pick up line" OR "hurry up" OR sweepstakes OR "sweep stakes" OR sweepstake OR "sweep stake" OR savings OR discount OR discounts OR discounted OR coupon OR coupons OR deal OR deals OR free OR offer OR offers OR bogo OR "$" OR "for sale" OR forsale OR "free shipping" OR "low price" OR "low prices" OR "list price" OR "pre-owned" OR printable OR promo OR promos OR promotion OR promotions OR promotional OR win OR voucher OR etsy OR "%" OR ebay OR "FREE w/ purchase" OR "free with purchase" OR "give away" OR "give aways" OR giveaway OR giveaways OR inventory OR "sold buy" OR shipped OR voucher OR vouchers OR "who wants to buy" OR "save up to" OR poshmark OR kijiji OR shopmycloset OR "check out" OR winner OR winners OR "gift card" OR giftcard OR "like this tweet" OR "to enter" OR "#ad" OR sponsored OR "good luck" OR goodluck OR "save up to" OR "5%" OR "10%" OR "15%" OR "20%" OR "25%" OR "30%" OR "40%" OR "50%" OR "use code" OR usecode OR "is gonna get"))

Reading Results

- Qualitative approach - we looked at sample posts and anecdotal examples that drive engagement or positive conversation. We wanted to deep dive into those example and discover themes that would stear our brand strategy

- Quantitative approach - we were surprised by the number of mentions Prep_H generates online. We estimated about 3K mentions over 12 months, we captured 30K over the same period of time. That’s 10x more and a significant nudge to consider how do we become part of this conversation and of the community that has been forming organically online

- Relevancy - it’s important to acknowledge that not all mentions are good, or useful. For us, political chatter turned to drive a lot of negative sentiment not for the brand but the topic itself. To ensure we stay focused, we decided to exclude any political conversations from the analysis

What we found

-

Not all key social media platforms drive the same level of conversation

-

Consumers mainly use “Preparation-H” when talking about the brand

-

Positive offline purchase experience was one of the key themes driving online conversations

-

Consumers discuss alternative uses of the product online, some very new to us!

-

Twitter users post threads, reflecting a story form

-

User generated content is full of self directed and peer to peer jokes

-

Combining our purchase intent query with our primary Preparation-H query helped surface the key insights we needed, underlining the light-hearted nature of the brand online and opportunities for our brand to engage

Insights to Action

-

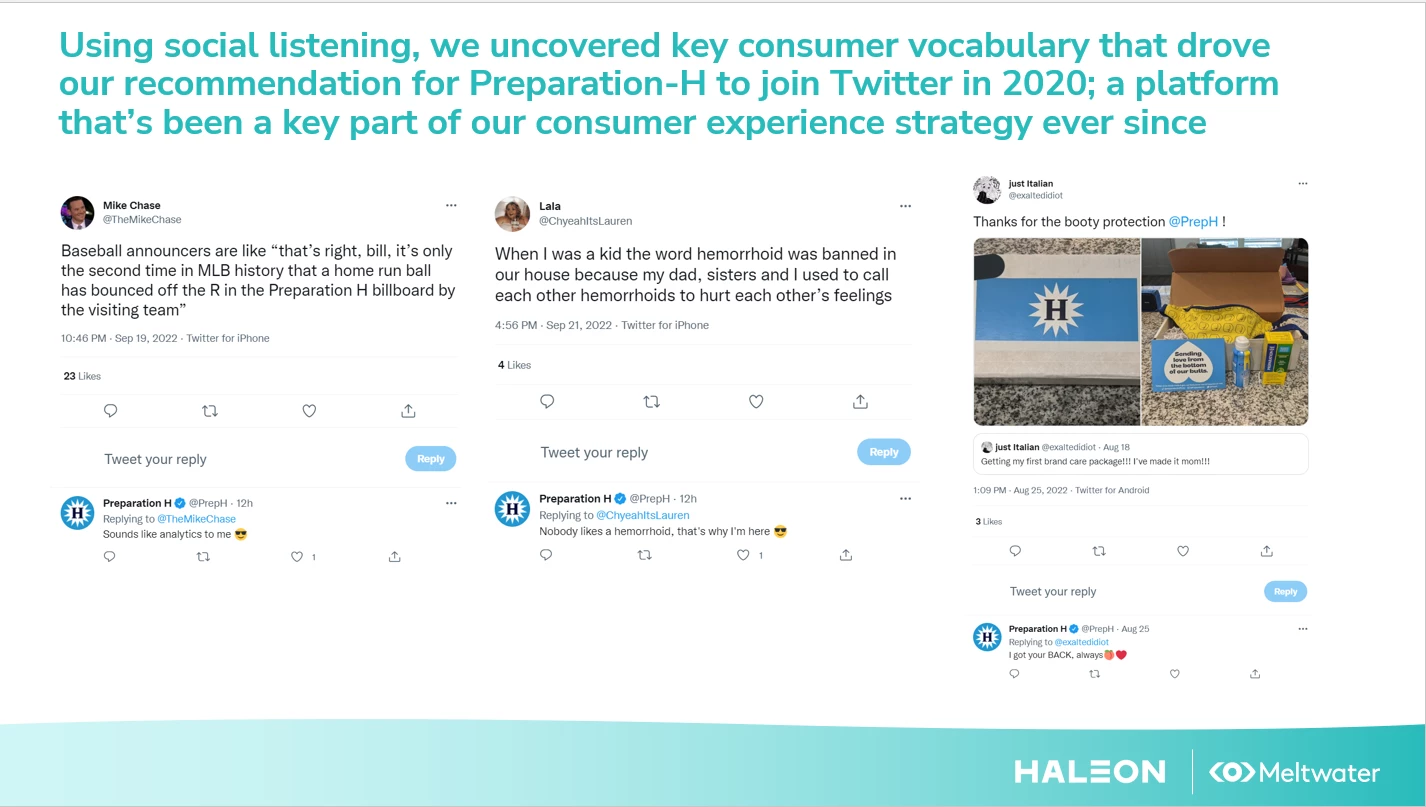

Prep H joined Twitter & Reddit, decision driven by volume & quality of conversation on selected channels

- When analyzing data across all major social platforms, we noticed that the majority of conversation (both quantitatively and qualitatively) takes place on Twitter and Reddit

- We had a solid argument on which channels should be prioritized and we did so based on data, rather than inclinc or a default logic

-

The brand tone of voice would be playful & anti taboo

- Online analysis revealed what we did not know - the humorous and informal language our customers use when discussing their offline product experiences

- Again, with solid examples and direction from our very own customers, we were able to decide what our online persona would be

Proof we made the right decision

Following the decision to enter social, we continued to measure Prep H’s online presence. Since joining the online conversation, we have noted continuous rise in Twitter followers and an overall reach of brand messages.

More specifically, the last 12 months (Oct’21 - Oct’22) analysis reveal that:

- Brand mentions are up 104%

- Organic mentions - Increased 76%

- Users talking about brand are up 161%

- Engagement (likes, up votes, emojicons) are up 272%